Nigerias Energy Transition

02 March 2022

The adoption of energy transition strategies and policies are designed to move the global energy sector away from fossil fuels towards zero-carbon energies by 2050 as determined by the Paris Agreement. There is universal acceptance of the need to transition in order to reduce energy related CO2 emissions and limit climate change. However, there also needs to be recognition that whilst aggressive energy transition programmes are being pursued in developed countries and by the international oil companies, many developing countries, and especially those with hydrocarbon-dependent economies such as Nigeria, require a more gradual and flexible approach to energy transition.

Nigeria is pursuing energy transition in order to promote economic growth and is gradually investing in renewable energies, primarily solar, in order to reduce carbon emissions whilst continuing to exploit hydrocarbon resources, especially natural gas – the energy transition fuel for Nigeria. Energy transition will continue to impact the ability of Nigeria and oil and gas companies to attract capital as banks and investors prioritise environmental, social and governance (“ESG”) factors and move away from funding hydrocarbon projects.

Nigeria has very low levels of carbon emissions – 0.61t CO2e per capita (2020) which compares to 14.24t CO2e per capita in the USA and 4.85t CO2e per capita in the UK. However, Nigeria is the seventeenth largest emitter of greenhouse gases globally due to CO₂ and methane emissions – gas venting and gas flaring – from oil and gas operations. Nigeria is aiming to reduce greenhouse gas emissions by 20% by 2030 through anti-gas flaring regulations and working closely with oil and gas companies.

During COP26, President Buhari stated that “Nigeria is actually more of a gas than oil producing country... requesting financing of projects using transition fuels, such as gas”. The President stated that Nigeria could still successfully exploit and utilise gas until 2040, without detracting from its commitments under the Paris Agreement.

This paper seeks to address the challenges and opportunities facing Nigeria in implementing its energy transition strategy and policies. The country seeks to find a balance between the development of renewable energies and the continued development of its oil and gas sector- both of which are critical to the country’s economic development. The paper will focus on the following:

Nigeria currently has one of the highest rates of energy poverty in the world. 1 in 3 households have no access to electricity and biomass and waste are the primary source of energy for cooking, especially in rural areas. Conversely, Nigeria has one of the highest costs of electricity in the world at an average of US$0.52/kwh. This is due to the widespread use and high cost of diesel generators, with an estimated 20 to 30 million operational diesel generators in the country – 25 to 60GW of capacity. Due to the dilapidated state of Nigeria’s oil refineries and despite being the largest oil producer in Africa, diesel must be imported which adds to the cost of generating electricity. Industrial, commercial and residential consumers rely on diesel generators due to the inadequate state of the country’s electricity infrastructure.

Despite having 12.5GW of installed generating capacity - ~80% gas fired with the remainder being hydro-power – the daily average electricity generated is only 4 – 5GW, due to the lack of reliable gas supplies and wholly inadequate distribution and transmission infrastructure.

In articulating its Energy Transition Plan at COP26 and at the UN General Assembly on High Level Dialogue on Energy in September 2021, the Federal Government of Nigeria (“FGN”) stated that for Nigeria to achieve its net-zero ambition by 2060, it would require over US$400 bn invested across the Nigerian economy (in excess of business-as-usual spending). This figure reflects the aggregate of US$155 bn required for generation capacity, US$135 bn on transmission and distribution infrastructure, US$79 bn on buildings, US$21 bn on industry and US$12 bn on transportation.

In supporting this robust plan, the FGN has undertaken numerous reforms to the power and the oil and gas sectors, in tandem with legislative policies to address energy transition and climate change. Notable power sector policies and initiatives include the National Renewable Energy and Energy Efficiency Policy ("NREEEP") which outlines Nigeria's plan to increase the use of renewable energy sources, and the Solar Power Naija initiative which seeks to electrify 5 million households and 25 million people using decentralised solar energy solutions. In addition, the Renewable Energy Master Plan ("REMP") seeks to increase the levels of renewable electricity in Nigeria from 13% in 2015, to 36% in 2030. This is a major first step towards closing Nigeria’s energy deficit by 2030 and which is supported by the World Bank, the African Development Bank and the Africa Growing Together Fund.

In various forum, including COP26, the FGN and various state players such as NNPC have emphasised the role of gas and the risk that limited international financing could jeopardise Nigeria’s energy transition and roadmap to attaining net-zero. They have also stressed the importance in recognizing the critical role of gas, as the transition fuel, and the need for developed countries and international energy companies to recognise the need to support the role of gas as a “clean fuel” in the FGN’s Energy Transition Plan.

The latest projections from the International Energy Agency (“IEA”) illustrate the challenges facing Nigeria in moving away from bioenergy and fossil fuels towards a balance with renewables.

Source: IEA World Energy Outlook 2019

The FGN is committed to the development of Nigeria's gas reserves in order to accelerate the country's economic expansion. In step with President Buhari's "Decade of Gas" declaration, there has been notable legislative reform and the issuance of gas-centric policies in a bid to attract local and foreign investment in the gas sector. Central to these reforms is the Petroleum Industry Act 2021 (the "PIA").

With respect to gas, the PIA includes a number of notable changes to preceding oil and gas legislation including the Petroleum Act 1969. The principle measures include:

Other tax incentives preserved under the PIA include: an initial tax-free period of three years (extendable by an additional two years) or as an alternative, an additional investment allowance of 35% or tax-free dividends during the tax-free period available under the Nigerian Companies Income Tax Act ("CITA"). It is however important to note that the Finance Act of 2021 has amended CITA with respect to these incentives, such that certain companies are now exempt from benefiting from the three year tax-free period namely:

The National Gas Policy (“NGP”) replaced the Gas Master Plan of 2008, and is designed with the objective of moving Nigeria from an oil-based economy to an oil and gas-based industrial economy. The principles of the NGP include realising more value from NLNG, pursuing a project-based rather than a centrally planned domestic gas development approach and establish strong links between the power, agriculture, transport and industrial sectors of the economy.

An important part of Nigeria's holistic approach to improving its energy efficiency and meeting its obligations under the Paris Agreement is eliminating gas flaring through gas utilisation projects. The Flare Gas (Prevention of Waste and Pollution) Regulations of 2018 (the "Gas Flaring Regulation") is an important regulatory step in achieving that, as it seeks to reduce the flaring of natural gas and create social and economic benefits from gas flare capture.

However, it should be noted that in 2021 the FGN suspended the implementation of the Gas Flaring Regulation and the auction of licences to process flared AG due to legal and funding uncertainties in issuing licences.

The National Gas Expansion Programme (“NGEP”) is another gas-centric initiative aimed at establishing compressed natural gas (“CNG”) as the fuel of choice for transportation and liquid petroleum gas (“LPG”) as the fuel for domestic cooking, captive power and small industrial complexes. In support of the NGEP the Central Bank of Nigeria has introduced a ₦250bn (~US$60m) intervention facility to help stimulate investment in the gas value chain. The objectives of the intervention facility include to:

Whilst the NGEP and the intervention facility are positive steps towards developing and utilising gas for domestic use, the scale of the challenge in attracting the finance required to fully exploit gas as the transition fuel, requires a commitment by both international and domestic sources of capital.

The development and utilisation of gas as a transition fuel towards the goal of net-zero emissions should not ignore the long-term role that gas will continue to play in global energy supply. In all of the global energy scenarios modelled by the IEA in its World Energy Outlook 2021, gas demand increases significantly and by 2050, 50% of gas consumed is used to produce low-carbon hydrogen and 70% of gas use is in facilities equipped with carbon capture, utilisation and storage (“CCUS”). The IEA projects that CCUS technologies deployment will increase from ~40Mt CO2 year capture in 2020 to ~1.6Gt CO2/year by 2030 and 7.6Gt CO2 by 2050.

The FGN has recognised CCUS as a key technology to support Nigeria’s energy transition and attain its climate targets. CCUS can underpin the long-term development and utilisation of gas and can act as a catalyst to decarbonise the industrial sector and develop new uses of gas, including low-carbon hydrogen production.

Nigeria's increased utilisation of its gas reserves is not without recognition of its international commitment to combat climate change. In November 2021, Nigeria enacted the Climate Change Act 2021 (the "CCA").

The key focus of the CCA is a framework for achieving low greenhouse gas emissions whilst promoting sustainable economic growth. The CCA reflects Nigeria’s revised Climate Change Policy which is administered by the Department of Climate Change within the Department of Environment.

For further information on Nigeria’s gas regulations and policies please refer to our “Reform of Nigeria’s Oil and Gas Industry, Key Considerations” paper published in November 2021 (available here).

As noted in Section 2.1, 2021 to 2030 has been designated as the “Decade of Gas”. The objectives of the FGN are to:

The Niger Delta (onshore and offshore), represents approximately 37% of total proven gas reserves in Africa. Proven reserves are ~201Tcf of which ~102Tcf is AG and ~99Tcf NAG. There is an additional ~600Tcf of unproven gas resources.

Historically Nigeria's domestic gas market has been underdeveloped with gas being primarily exported as LNG and GTL, re-injected to enhance oil recovery or flared. The bulk of gas produced is AG with the country's NAG reserves largely untapped..

Most oil fields have high gas-oil ratios. The IOCs remain the major producers of both AG and NAG but indigenous E&P companies are increasing their role with several companies focused on developing gas for domestic utilisation (e.g. Seplat, ND Western, FIRST E&P) both onshore and in shallow water OMLs. Average daily gas production in 2020 was 7,461mmscfd and was split between the JVs, PSCs and NPDC as follows:

| JV | pscs | npdc | |

|---|---|---|---|

| Gas Vol (mmscfd) | 5,346 | 1,551 | 831 |

| % of Total | 69% | 20% | 11% |

Source: NNPC Monthly Operations Report Sept 2020

The importance of developing the country’s AG and NAG reserves was emphasised in 2018 by the Department of Petroleum Resources when approving 20-year extensions of multiple OMLs. A condition of approval was that if the OML contained material AG or NAG reserves, the operator of the OML had to submit a gas development plan within 2-years of OML renewal being granted.

In pursuing their energy transition strategies, the recent and ongoing divestments by several IOCs provide further opportunities for Nigeria to capitalise on the development of its gas resources, as the assets being divested contain significant undeveloped NAG reserves and resources. These divestments are sizable – Chevron US$250m, ExxonMobil ~US$1.5bn, SPDC ~US$3.5 – 4bn – and will test the liquidity of international and domestic markets for capital and the ability of the buyers and sellers to devise innovative capital structures.

The acquirors of these assets – NNPC and indigenous E&P companies – will potentially seek international partners in order to fully capitalise on the value potential and role in Nigeria’s energy transition that developing the NAG represents.

Table: Gas Rich IOC Divestments

| seller | omls | onshore/offshore | estimated gas reserves/resources (tcf) |

|---|---|---|---|

| Chevron | 86 & 88 | Offshore | 8.2 |

| ExxonMobil | 67, 68, 70 & 104 | Offshore | 13.7 |

| SPDC | 18 OMLs | 15 onshore/3 offshore | 12.4 |

Source: Wood Mackenzie; public disclosures

Domestic utilisation of gas remains low with LNG and GTL exports continuing to represent the bulk of gas produced. The policies outlined in Section 2 above, coupled with ongoing gas development and infrastructure projects, will address this imbalance and result in significantly higher rates of gas utilisation for domestic use (e.g. power generation, LPG and CNG production and gas based industries).

Table: 2020 Gas Production and Utilisation

| gas utilisation | volume (bcf) | utilisation factor (%) | |

|---|---|---|---|

| Export | NLNG | 3,141,19 | |

| Escravos GTL | 189.93 | ||

| NGL/LPG | 95.03 | ||

| WAGP | 83.84 | ||

| Total Export | 3,509.99 | 45.53% | |

| Domestic | Gas Re-injection | 2,060.28 | 26.73% |

| Local Supply (Power) | 681.38 | 8.84% | |

| Flare Gas | 567.56 | 7.36% | |

| Local Supply (Others) | 493.27 | 6.40% | |

| Fuel Gas | 396.33 | 5.14% | |

| Total Domestic Use: | 4,198.82 | 54.47% | |

| Total Gas Utilised: | 7,708.81 | 100.00% |

Source: NNPC Monthly Operations Report Sept 2020

Major gas trunklines are operated by subsidiaries of the Nigeria Gas Company whilst many gas gathering, processing and spur lines are operated by the IOCs and indigenous E&P companies. One of the major constraints historically in transporting gas for domestic use has been the absence of East – West, East – Central – North connections.

A critical part of the FGN’s gas strategy are NNPC’s Seven Critical Gas Development Projects which were sanctioned in July 2018. The projects, when completed will significantly impact the processing and transportation of gas and domestic utilisation especially in power generation and gas-based industries..

NNPC's Seven Critical Gas Development Projects

| S/N | IDENTIFIED PROJECTS/SYNERGY | EXPECTED VOLUME (MMSCF/D) | GAS SUPPLY & INFRASTRUCTURE DEVELOPMENT REQUIRED |

|---|---|---|---|

| 1 | Assa North-Ohaji South Gas Field Development (SPDC JV/NNPC) | 300 |

|

| 2 | Joint Development of OML24 (NNPC/NewCross) and OML18 (NNPC/Eroton) on top of 100mmscf/d already delivered by Alakiri Gas Plant | 205-300 |

|

| 3 | Development of 4 SPDC JV/NAOC JV Unitised Gas Fields (Samabri-Biseni, Akri-Oguta, Ubie-Oshi, and Afuo-Ogbainbiri) | 500-600 |

|

| 4 | Cluster Development of NPDC's OMLs 26, 30 & 42 | 500-600 |

|

| 5 | SPDC/NNPC JV Gas Supply to Brass Fertilizer Company FID taken Jan 2021 |

270 |

|

| 6 | Cluster development of OML 13 to support the expansion of Accugas Uquo Gas Plant | 400 |

|

| 7 | Cluster Development of Okpokunou / Tuomo West (OMLs 35/62)(Straddling + Non-Straddling) in Phases (5Tcf) | 500-600 |

|

Source: NNPC and company press releases

As noted in 2.1.2 above, the NGP provides a roadmap to transition Nigeria from an economy dependent on oil exports (70% of government revenues) to a gas-based industrial economy. This is critical to the future economic development of Nigeria and in providing reliable and affordable gas and electricity to Nigeria’s rapidly growing population.

The development and commercialisation of gas for domestic use is largely dependent on:

Whilst renewable energy, primarily solar, will have an impact in the long-term, especially through micro-grids, Nigeria must continue to expand the development and utilisation of gas as it progresses towards its target of net zero emissions by 2060.

Biomass and waste are the primary source of energy in Nigeria and especially for cooking which has significant environmental impacts including increased carbon emissions and deforestation. There is a specific focus in the NGEP on expanding the use of LPG as a cooking fuel through the National LPG Expansion Plan. The plan projects increasing LPG use from ~5% to 90% by 2031. In support of this programme, in late 2021 NLNG began reducing its LPG exports in order to increase domestic supplies and will supply 450,000mt per annum.

The IEA have forecast that Nigeria will require US$445bn of investment in cumulative energy supply through 2040, 80% of which will be required by the oil and gas sector. Financing oil and gas projects is becoming more complicated as banks, multilateral lenders and investors divert capital away from fossil fuels to renewable energies. During COP26 a number of countries and financial institutions pledged to stop funding fossil fuel projects and this, combined with the net zero carbon targets being adopted internationally, is presenting significant challenges as Nigeria tries to balance the needs of the country to continue developing its oil reserves in order to generate revenue, whilst at the same time developing gas as the transition fuel.

Nigerian Vice President Yemi Osinbajo has stated “shutting off of capital in energy infrastructure will not result in a just energy transition and the attitude towards natural gas needs to be looked at from an energy access and energy poverty point of view”.

This is resulting in the need for innovative funding structures designed to attract capital from traditional and non-traditional sources and also project sponsor flexibility to access funding. Nigeria has and continues to attract capital for oil and gas projects and in the past two years approximately US$9.5 bn of debt has been committed by international and domestic sources of capital. This has included US$5.9 bn specifically for major gas projects (e.g. NLNG Train 7, the Ajaokuta- Kaduna-Kano gas pipeline).

The scale of the financing challenge cannot be underestimated. However, as demonstrated by several recent oil and gas financings, capital is being structured by a broad range of international and domestic providers.

| date | amount (us$m) | borrower | loan type | use of funds | source of funds |

|---|---|---|---|---|---|

| May-20 | 3,000 | NLNG | Hybrid Corporate Finance | Train 7 Project | 26 Nigerian & international banks, 3 ECAs, 2 DFIs |

| Jul-20 | 1,500 | NNPC | Forward Sale Agreement for 30M bopd |

E&P cash calls, NPDC royalty payments |

Vitol, Matrix Energy, Afrexim, UBA |

| Jan-21 | 1,067 | Heirs Oil & Gas | Senior Secured A&B, Junior Notes, Subordinated Notes, Working Capital Facility |

Acquisition of SPDC JV 45% working interest in OML 17 |

SCB, Afrexim, United Bank, AFC, ABSA, Hybrid Capital, Amundi |

| Feb-21 | 260 plus 60 equity rebalancing | ANOH Gas Processing Company | Limited Resource Project Finance | Debt finance portion of US$650m ANOH gas project | Zenith, UBA, Union Bank, Stanbic IBTC, RMB, MCB, FCMB |

| Jul-21 | 50 | Seplat | Pre-payment Facility | OML 40 development | Shell West |

| Aug-21 | 2,600 | NNPC | Project Finance | Construction of the 614km Ajaokuta-Kuduna-Kano gas pipeline | Bank of China, Sinosure |

| Nov-21 | 1,040 | NNPC | Forward Sale Agreement for 35M bopd | E&P cash calls | Afrexim |

| Jan-22 | 200 | Sirius Petroleum | Senior Loan Facility | OML 65 development | Trafigura |

Sources: Bloomberg and respective company press releases

Oil and gas project sponsors must contend with several factors that make structuring and completing funding challenging:

The lender/investor universe for Nigerian oil and gas financings continues to evolve:

The challenges facing independent E&P companies seeking to acquire assets being divested by the IOCs cannot be underestimated but well defined and bankable structures, coupled with credible and established sponsors, will attract and be able to structure acquisition and development funding.

A number of these challenges have and are being addressed through legislation, the execution of major gas infrastructure projects and the transition to bankable contractual frameworks for gas.

To successfully raise the capital required to fully exploit gas as the transitional fuel and achieve Nigeria’s long-term energy goals, the FGN, project sponsors and capital providers will need to work closely together to identify, allocate and mitigate the complex issues and risks that impact major gas projects..

A recent hybrid financing structure that may serve to illustrate how future acquisition and development oil and gas financings may be structured was the ~US$1.1 bn acquisition financing raised by Heirs Oil & Gas (“Heirs”), an indigenous E&P company for the acquisition of the SPDC JV 45% working interest in OML 17.

The financing structure was unique in a Nigerian oil and gas financing as it incorporated:

The senior debt was structured as a conventional RBL which attracted traditional debt providers and two tranches based on an extended NPV basis which attracted non-bank institutions (e.g. asset managers and hedge funds).

Other features of the financing which proved critical to Heirs and attractive to lenders and investors were the stretched tenors of the junior debt, the revolving oil services funding facility and the structured notes, all of which have 7-year tenors.

Whilst OML 17 is both an oil and a gas play, the significant >1Tcf of associated gas (AG) and undeveloped non-associated gas (NAG) will feature prominently in Heirs’ strategy to further develop OML 17.

The challenges and some of the mitigates and structuring considerations in financing gas-related projects are discussed in Subsections 4.2.3 and 4.2.4 below. One of the main challenges facing gas companies in Nigeria, in addition to being reliably paid for gas delivered, is receiving payment for US$ GSAs in Naira and then having to service US$ debt with the exchange rate uncertainties that this entails.

An example as to how to address this issue, attract non-traditional investors and which may set a precedent for other gas companies, is the recently announced planned restructuring by Savannah Energy of a US$371 m debt facility held by its Accugas subsidiary which matures in 2025 and is priced at LIBOR +10.5%.

Accugas currently has four US$ denominated GSAs, three of which have credit support, including one backed by the World Bank Partial Risk Guarantee. The planned restructuring of the Accugas debt into Naira involves three tranches:

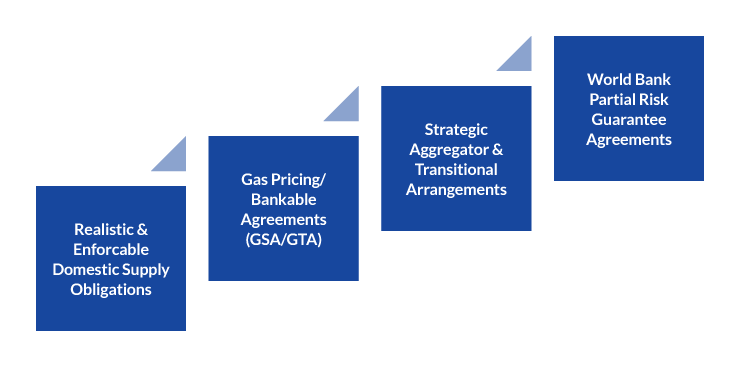

One of the major challenges companies and lenders/investors in the Nigerian gas sector have faced is how to structure and implement a bankable contractual framework. This is being achieved as illustrated below:

I. Realistic & Enforceable Domestic Supply Obligations

A Domestic Supply Obligation (“DSO”) framework as enshrined in the PIA

Gas producers develop supply plans to meet their annual DSOs

New and planned gas pipelines to transport gas to industrial/commercial markets

II. Gas Pricing/Bankable Agreements (GSA/GTA)

III. Strategic Aggregator & Transitional Arrangements

IV. World Bank Partial Risk Guarantee Agreements

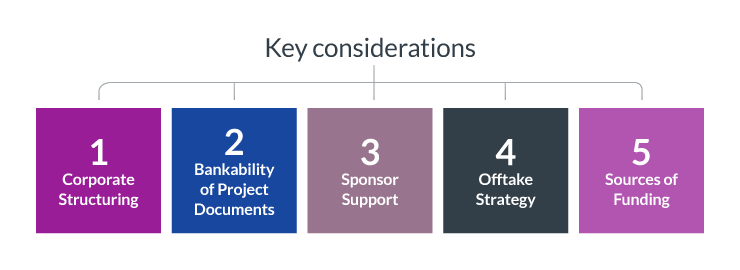

When reviewing the financing of gas projects, providers of funding will require a bankable contractual framework as illustrated above and look at several other factors that will be key to the project securing funding.

1. Corporate Structuring

2. Bankability of Project Documents

3. Sponsor Support

4. Offtake Strategy

5. Sources of Funding

The landscape of sources of funding is varied, international and domestic can be illustrated as follows:

| source of funding | availability | comment |

|---|---|---|

| Intl. E&P Companies | + | Limited number of companies - given Nigeria risk, but several "strategic" players |

| Private Equity | + | Limited - given country risk, minimum IRR Criteria |

| Hedgefunds | + | Limited but playing an increasing role in mid-stream gas |

| Equity Markets | + | Limited - given equity trading values & prevailing NPVs (i) |

| International Banks | + + | Interest in well structured transactions, credible sponsors (ii) |

| Domestic Banks | + + | Interest in supporting core domestic clients |

| Commodity Traders | + + | Historically focused on oi only but moving into gas (e.g. LPG, LNG) |

| Service Companies | + | Provide $ linked to provision of oilfield services |

| Infrastructure Funds | + + | Limited interest in upstream oil, focus on gas midstream/downstream |

| Bilateral Funds | + + + | Funding for structured transactions, increased focus on gas and infrastructure |

| ECAs | + + | Significant players in major gas infrastructure projects |

Notes:

(i) Major institutional investors restricting investments in oil & gas companies due to Climate Action 100+ and broader ESG policies

(ii) Increasingly linking credit/lending decisions based on adherence by sponsors to The Equator Principles and ESG policies

The road leading to Nigeria achieving its aim of net-zero emissions by 2060 is both long and complicated given the essential role of hydrocarbons in the economy and the country’s energy deficit. Providing affordable and reliable sources of energy for a population which is forecasted to exceed 400 million by 2050 is highly challenging, especially when combined with Nigeria's commitments made under the Paris Agreement and COP26 and the impact that global energy transition policies are having on the funding and development of oil and gas projects.

For Nigeria to progress and succeed in its energy transition strategy it will be necessary to continue to develop the country’s significant gas reserves and resources whilst at the same time progressing the introduction of renewable energy sources – particularly solar – at a local level for example through establishing micro-grids. The role of gas as the transition fuel is a reality in terms of moving Nigeria from an oil-based economy to a diversified industrial economy which can both meet the needs of its growing population and achieve the net-zero objectives outlined at COP26.

The challenges and opportunities presented by the focus on gas are significant and require both technical solutions and financial innovation in order that the economic and environmental benefits of Nigeria’s gas be realised. The development of gas-based solutions – LPG, CNG, FLNG – will all contribute to promoting gas-based industries and to finding solutions to the country’s chronic power sector deficit.

It is critical that the different socio-economic and developmental needs of Nigeria, when compared to developed countries, are recognised. In addition, the relatively low level of carbon emissions in Nigeria when compared to the high level of those in developed countries who are at the forefront of the energy transition requires understanding by the international community and therefore that optimising the development and use of gas domestically is critical to the country’s energy transition.

International lenders and investors will need to continue to play a critical role in financing the development of gas as Nigeria’s transition fuel and this will require a more balanced approach to funding oil and gas verses renewable energy. The involvement of bilateral funds, development banks and institutions and infrastructure funds, coupled with innovative and flexible capital structures that recognise the risks, timeframes and potential rewards of funding gas projects, is and will remain key to capitalising on Nigeria’s gas opportunities.

The “Decade of Gas” is already well progressed in terms of changes made in legislation and policies, major ongoing gas infrastructure projects and the level of funding that is being sourced from domestic and international sources of capital. This represents a major opportunity to transform the country’s economy and provides a realistic and ultimately achievable path to achieving Nigeria’s energy transition.

This article has been a joint collaboration between Ashurst LLP and Michael Humphries of Redcliff Energy Advisors. It summarises our understanding of the issues discussed but does not constitute legal, accounting or financial advice and should not be relied on without discussions with us and, where appropriate, Nigerian lawyers.

The information provided is not intended to be a comprehensive review of all developments in the law and practice, or to cover all aspects of those referred to.

Readers should take legal advice before applying it to specific issues or transactions.