The end of open access What the future holds for transmission access reform in the NEM

19 May 2022

19 May 2022

The current open access regime allows generators to negotiate a connection to any part of the network at any time, subject to the network connection process with the relevant transmission network service provider (TNSP) and the Australian Energy Market Operator (AEMO). Generators fund only the cost of the assets required to connect to the grid and do not contribute to the cost of the shared transmission network. Generators receive no guarantees that the network will be capable of transporting their output to load centres.

At present, generators locate in parts of the network that are already at capacity provided they can achieve lower generator coefficients (i.e. the coefficient that reflects the impact a generator has on a constrained transmission line from a one MW change in output) than competitors. This is because the National Electricity Market Dispatch Engine (NEMDE) prioritises the dispatch of generators with lower coefficients, all else being equal, to minimise the amount of energy lost due to congestion.

The ESB notes that the current open access regime is causing the following to occur:

The congestion zones with connection fees model segregates the transmission system into zones that reflect the level of available hosting capacity for new generation. These zones signal to developers and investors which parts of the network are available for further development, which parts are reaching capacity and which parts are full.

Under the model, new market entrants would be incentivised to locate in areas with lower congestion by being charged lower connection fees. Connection fees may also be scaled depending on a generator's output profile. Incumbents are not subject to the connection fees given they have already chosen their locations. Storage may be exempt from connection fees or rewarded for offering congestion relief. Connection fees that REZ projects pay for access rights may be treated as a substitute for a connection fee under the model.

Whilst fees would be fixed at the time of connection, generators could negotiate how to pay the fees over the life of the asset. The connection fees would be determined by the regulatory framework (i.e. fees would be set by TNSPs and approved by the AER as part of their transmission charging methodology).

The transmission queue model establishes a two-step queue allocation method that confers priority rights to incumbent generators and thereafter on a first come first served basis (i.e. if the network has spare capacity) or via an auction (i.e. if the network is over-subscribed).

First, AEMO would determine the available transmission capacity in the network by analysing historical data on thermal capacity, voltage and stability requirements.

Second, participants would submit expressions of interest (EOI) to connect to the grid.

Third, depending on the demand for transmission capacity, a queue allocation mechanism would apply as follows:

New generators who are lower in the queue can improve their position by paying transmission charges or installing storage. If a generator is willing to fund investment to offset the additional congestion they cause, they would be given a queue number of “zero”.

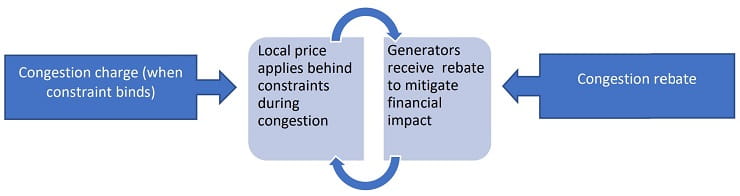

The CMM with universal rebates introduces a single, combined-bid energy and congestion market. When a constraint is non-binding, the current NEM open access regime applies. When a constraint is binding, the CMM introduces a dual system of congestion charges and rebates for market participants in eligible locations.

The below diagram illustrates a simplified version of the CMM with universal rebates.

Source: ESB

Market participants who generate in congested areas would be subject to a charge that reflects the marginal cost of congestion at their location. In response to the charge, generators would align their bidding to the true cost of generation in order to be dispatched by NEMDE, thereby reducing the cost of dispatch. By receiving the regional reference price (RRP) and paying a congestion charge, generators are, essentially, facing a locational marginal price (LMP). Given demand-side and two-way technologies can access lower prices relative to the RRP, they are rewarded for providing congestion relief in congested areas.

When congestion occurs, market participants (incumbents and new entrants, irrespective of whether they locate in a REZ) that are subject to the constraint would be eligible to receive a congestion rebate from a rebate pool to mitigate any exposure to LMP. The ESB is consulting with stakeholders regarding design choices for rebate allocation metrics, including applying the queue mechanism or using availability, contribution factors or inferred economic dispatch (i.e. assumed cost) as the metric.

The CRM establishes an ancillary services market to relieve congestion in operational timeframes. This would enable market participants to trade “congestion relief” every five minutes based on an initial dispatch run. If a participant is dispatched and it does not make an offer to sell congestion relief, it would be paid the RRP for its dispatch quantity. The trading of congestion relief enables low-cost participants to be dispatched ahead of higher cost participants through a compensation process.

First, market participants’ (initial) dispatch of energy as per the status quo arrangements would determine the prospective buyers and sellers of congestion relief in the CRM as follows:

Second, buyers and sellers would bid or offer into a separate CRM for each binding constraint.

Third, the quantity of congestion relief being bid or offered would be adjusted by each participant’s contribution factor in the constraint.

Finally, the market clears, determining a clearing price and quantity of congestion relief traded.

If a participant sells congestion relief, the quantity of congestion relief is settled at the congestion relief price (not the RRP).

If a participant buys congestion relief,

Authors: Paul Curnow, Partner; Andre Dauwalder, Senior Associate; Joshua Hetzel, Lawyer; Miranda Aprile, Graduate; Sarah Gough, Seasonal Clerk.

The information provided is not intended to be a comprehensive review of all developments in the law and practice, or to cover all aspects of those referred to.

Readers should take legal advice before applying it to specific issues or transactions.